MIRA Issues Regulation on Information Submission for Special Economic Zone Developers and Investors

Pursuant to section 70(b) of the Special Economic Zones Act1(“SEZ Act”), Maldives Inland Revenue Authority (“MIRA”) has issued a regulation2 detailing the information submission requirements for developers and investors in Special Economic Zones (“SEZs”).

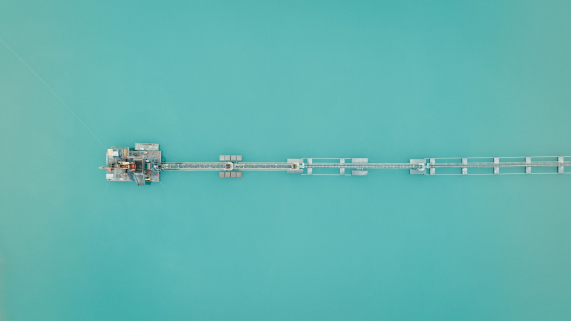

This regulation follows the Maldivian government’s recent Memorandum of Understanding with Dubai’s International Free Zone Authority (IFZA), which was signed on 12 May 2024 to develop a special economic and financial services zone in K. Funadhoo near Malé and the Maldives Economic Gateway in Ihavandhippolhu in the north.

The regulation specifies the procedures for submitting documentation necessary to evaluate the scale of economic activities within SEZs and to calculate the “tax expenditure” related to the incentives and benefits offered under the SEZ Act.

Documentation requirements

Under the regulation, SEZ developers and investors are required to submit an annual tax return or a statement as prescribed by MIRA for SEZs along with the following documents by 30th June of the following year.

- Audited Financial Statements

- Auditors Report

- Directors Report (only applicable for companies)

The regulation further prescribes that the Audited Financial Statements should be prepared using accrual basis of accounting and presented in either United States Dollars or Maldivian Rufiyaa, depending on the entity’s functional currency. Entities with a functional currency other than Maldivian Rufiyaa are required to present the Audited Financial Statements and accompanying documents in United States Dollars, while those whose functional currency is Maldivian Rufiyaa should use Maldivian Rufiyaa as their presentation currency.

Moreover, the SEZ developers and investors must prepare and maintain transfer pricing documentation for transactions with associates, as outlined in section 68(b) of the Income Tax Act.

Additional matters

The Zone Superintendent from the Board of Investments for each SEZ must provide quarterly reports to MIRA. These reports, containing details about authorised developers and investors in the zones as well as any permit revocations, are to be submitted by the 15th of the month after each quarter ends.

Additionally, the regulation specifies that the information provided by SEZ developers and investors will be shared with the Ministry of Finance for the purpose of calculating tax expenditure related to the incentives and benefits offered under the SEZ Act, and this will not be regarded as a violation of confidentiality.

Effective date

28 October 2024