MIRA Calls Upon Taxpayers That Do Not Meet Registration Requirements to Deregister

The MIRA has issued announcements requesting taxpayers who do not fulfil tax registration requirements under the Tax Administration Act, or GST registration requirements to deregister from tax.

The announcement, issued on 16 January 2019, reminds…

Cash Declaration Limit Changed

The Maldives Monetary Authority, on 17 January 2019, published the first amendment to the Regulation on Cross Border Currency Declaration Amount.

The changes introduced now require passengers travelling with USD 20,000 or more, and are travelling…

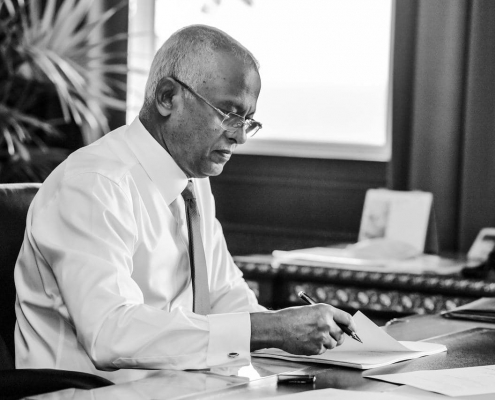

President seeks Parliamentary consideration on joining the Convention on Mutual Administrative Assistance in Tax Matters

On 29 February 2021, the President’s Office issued a press release on seeking parliamentary consideration on joining the Convention on Mutual Administrative Assistance in Tax Matters.

Regulation on Pensionable Wage Published

The Regulation on Pensionable Wage was gazetted on 25 February 2021. The primary objective of the Regulation is to provide for the requirements related to Pensionable Wage for the purposes of calculating contributions to Maldives Retirement Pension Scheme (MRPS).

CTL Strategies Celebrates its 6th Anniversary

CTL Strategies has been ranked in the 2021 edition of Chambers and Partners, which is often regarded as the “gold standard” in the legal profession.

Travel Agency Regulation

On 25 February 2021, the Travel Agency Regulation was gazetted, replacing the regulation that was in place since 2006. The new regulation introduces new rules for both foreign and local tour agencies.

Overview of Tenth Amendment to the Tourism Act

This publication gives an overview of the 10th Amendment to the Tourism Act.

CTL Strategies recognised in 2021 Rankings of Chambers and Partners

CTL Strategies has been ranked in the 2021 edition of Chambers and Partners, which is often regarded as the “gold standard” in the legal profession.

Year in Review 2020

Our "Year in Review 2020" provides brief summaries of the key legal and tax developments through the year 2020, as the Maldives navigated its way through the COVID-19 pandemic. Some of the issues have also been addressed to in blog posts by our lawyers and tax advisors, and in a variety of our publications.

Overview of Third Amendment to Tax Administration Act

This publication gives an overview of the imposition of the Third Amendment to the Tax Administration Act, that was published in the Government Gazette on 16 December 2020.

Third Amendment to the Tax Administration Act

The Third Amendment to the Tax Administration Act was published in the Government Gazette on 16 December 2020.

Twenty Eight Amendment to GST Regulation

Maldives Inland Revenue Authority (‘MIRA’) on 15 December 2020, published the Twenty Eight Amendment to the Goods and Services Tax Regulation.