MIRA Calls Upon Taxpayers That Do Not Meet Registration Requirements to Deregister

The MIRA has issued announcements requesting taxpayers who do not fulfil tax registration requirements under the Tax Administration Act, or GST registration requirements to deregister from tax.

The announcement, issued on 16 January 2019, reminds…

Cash Declaration Limit Changed

The Maldives Monetary Authority, on 17 January 2019, published the first amendment to the Regulation on Cross Border Currency Declaration Amount.

The changes introduced now require passengers travelling with USD 20,000 or more, and are travelling…

Foreign Investment Opportunities in the Maldives

It is important to enlist the help of skilled counsel with experience in legal, administrative and, tax requirements when foreign investors establish themselves in the Maldives as their choice of business structure can have different tax and legal implications.…

Tourism Ministry Introduces Share Transfer Fee and Increases Lease Transfer Fee Under Grant of Rights Regulation

The Ministry of Tourism, on 31 October 2017, published the 4th Amendment to Regulation Number 2010/R-14 (Grant of Rights – land and islands leased for tourism purposes) which, by effect of the Amendment, transfers fee impositions from Regulation Number…

New Ruling Changes Complimentary Services Rules

The Maldives Inland Revenue Authority has published a Tax Ruling (Number TR-2017/G43) on 9 October 2017 which amends Section 54 of the Goods and Services Tax Regulation to allow complimentary supplies without any imposition of GST for a period of 7 days.

Prior…

High Court Rules Laamu Asseyri Project Contract Void

The High Court, on 4 October 2017, struck down the lower court’s decision to enforce a contract between J Hotels and Resorts Private Limited and the State.

In the case decided by the Civil Court in favor of J Resorts, it was held that there was in…

CTL Strategies Concludes Second Annual Corporate Retreat

CTL Strategies has concluded their second annual corporate retreat on 1st October 2017.

The 4-day corporate retreat of CTL strategies was held on Fulhadhoo island, which lies on the outer rim of Baa Atoll – well known for its wealth of unique sea-life…

CTL Strategies Appointed as Gold 100 Evaluators

CTL Strategies LLP has been appointed as the evaluators of Gold 100, 2017.

Gold 100, which is a feature on the leading business enterprises in Maldives and published in Corporate Maldives - a premium business and hospitality magazine - undergoes a…

Mandatory General GST Registration for Tourism GST Registrants

The Maldives Inland Revenue Authority has published Ruling G42 on 7 September 2017 which amends Section 11 of the Goods and Services Tax Regulation.

The amended Section 11 requires persons who are already registered for Tourism GST to register for…

Land Sale Regulation Grants the Minister Power to Set Minimum Tax

The Ministry of Housing and Infrastructure, on 15 August 2017, published the 2nd Amendment to the "Regulation on Privatising and the Sale and Purchase of Land 2008" which changes the composition of the committee created under Section 10 and, allows the…

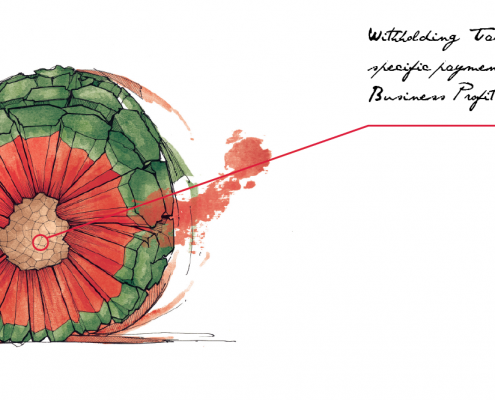

CTL Strategies Conducts Seminar on WHT for Tourism Professionals

A seminar on "Contemporary Issues on Withholding Tax in the Tourism Industry" was conducted by CTL Strategies on 12 August 2017.

The seminar held at hotel Jen was attended by CFO's and accounting executives from several 5 star and 6 star tourist establishments.

The…

Tourism Permit Not Required Prior to Signing Management Agreements

The Ministry of Tourism, on 3 August 2017, published the 3rd Amendment to Regulation Number 2010/R-14 (Grant of Rights – land and islands leased for tourism purposes) which allows for the signing of a management agreement prior to receiving the relevant…