MIRA Calls Upon Taxpayers That Do Not Meet Registration Requirements to Deregister

The MIRA has issued announcements requesting taxpayers who do not fulfil tax registration requirements under the Tax Administration Act, or GST registration requirements to deregister from tax.

The announcement, issued on 16 January 2019, reminds…

Cash Declaration Limit Changed

The Maldives Monetary Authority, on 17 January 2019, published the first amendment to the Regulation on Cross Border Currency Declaration Amount.

The changes introduced now require passengers travelling with USD 20,000 or more, and are travelling…

Seminar on Tax Audits and Appeals

CTL Strategies is conducting a full day seminar on Tax Audits and Appeals. The six-hour seminar is designed to give participants an in-depth understanding of the audit process, including the steps leading up to the audit process, such as some considerations…

New Guidelines on Acquisition Costs Payable under Boundary Regulation

The Tourism Ministry, on 7 May 2018, published a guideline specifying the acquisition cost payable under Section 3(b)2(iii) of Regulation Number 2012-R7 (Boundary Regulation).

As per Section 2(a), the guideline indicates that the acquisition cost for…

Top Court Rules in Favor of Villa in Lease Termination Case

On 18 April 2018, the Supreme Court of Maldives decided in favor of Villa Shipping and Trading Company Private Limited and several companies related to Villa, following a prolonged dispute originating in 2015 regarding the lease of tourism islands.

The…

Major Changes to Framework of MIRA Registered Auditors

The Maldives Inland Revenue Authority (“MIRA”), on 5 April 2018 published Tax Ruling B-63 (Submission of Financial Statements and Appointment of Auditors) which supersedes Ruling B-57 and changes some requirements for auditor registration and renewal…

Customs Guidelines Allow for Cargo to be Offloaded at Resorts Under Development

The Maldives Customs Service, on 29 March 2018, published guidelines for offloading imported goods directly to tourist resorts undergoing development.

The guidelines, which are in effect from 1 April 2018 to 31 December 2020, allow new resorts which…

Year in Review 2017

This edition of Year in Review focuses on the major changes in tax rules and important regulatory changes in 2017 that impacts businesses in the Maldives. You can refer to our publications on the same rulings or changes to find out more information regarding…

The Maze of Withholding Tax

by Husam Shareef, Tax Advisor

As you may notice from the heading, the rules on payment of Withholding Tax (WHT) have become rather complex - creating a maze that you need to carefully navigate. Finding out about compliance issues during a tax audit…

Changes in Regulation Allow for Extension of Acquisition Fee Payment Period for Tourism Islands

The Ministry of Tourism, on 4 March 2018 published the 2nd Amendment to Regulation Number 2016/R-69 (Submission of Proposals for Leasing Islands, Plots of Land and Lagoons for Tourism Purposes) effectively granting an extension of the acquisition fee…

New Ruling makes Construction of Social Housing Projects an Exempt Supply

The Maldives Inland Revenue Authority has published Ruling G46 on 8 February 2018 which makes the construction of housing projects under a social housing scheme, an exempt supply.

To qualify that project as an exempt supply, the GST registered party…

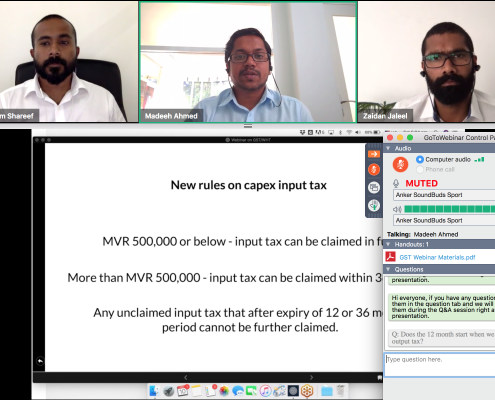

CTL Conducts Webinar on Recent Tax Rulings

A web-based seminar on "Recent Developments on GST and WHT" was held by CTL Strategies on 10 February 2018, which focused on some important changes to the Goods and Services Tax regime and Withholding Tax regime.

The first of it's kind conducted by a…