MIRA Calls Upon Taxpayers That Do Not Meet Registration Requirements to Deregister

The MIRA has issued announcements requesting taxpayers who do not fulfil tax registration requirements under the Tax Administration Act, or GST registration requirements to deregister from tax.

The announcement, issued on 16 January 2019, reminds…

Cash Declaration Limit Changed

The Maldives Monetary Authority, on 17 January 2019, published the first amendment to the Regulation on Cross Border Currency Declaration Amount.

The changes introduced now require passengers travelling with USD 20,000 or more, and are travelling…

Interest limitation rules under the Income Tax Act

This article explains the interest limitation rules under the Maldives Income Tax Act, with specific focus on thin capitalisation rules, 6% rate cap, and transfer pricing.

Calculating your interim payment for 2020

Income Tax Act has special rules on calculation of interim payment where a taxpayer estimates the tax liability of this year to be lower than that of the previous year. This article explains how these rules can be applied in practice.

Selling a land or property? Know your tax implications

From 1 January 2020 onwards, with the commencement of the Income Tax Act (ITA), land sales tax has been repealed and sale of properties will continue to be taxed under the Capital Gains Tax regime under the ITA.

Tax Implications of the Employee’s Income Tax Borne by the Employer

Some employers may decide to pay income tax on behalf of the employee. In some jurisdictions, such tax payments made by the employer are not considered as a taxable benefit. The case, however, is not the same in the Maldives. This article illustrates how this applies in practice, and how it affects the tax liability of the employee.

COVID-19 and Voluntary Liquidation

COVID-19 pandemic may force some companies to file for liquidation. This article summarises the procedures to be followed in such a voluntary liquidation.

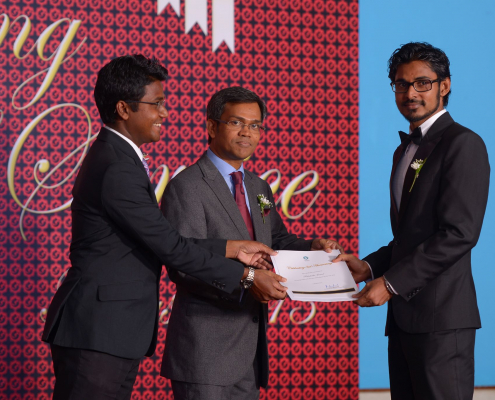

New Commissioner General Appointed to MIRA

On 31 October, President Ibrahim Solih, appointed Fathuhulla Jameel as Commissioner General of Taxation and Asma Shafeeu as Deputy Commissioner General of Taxation.

Fathuhulla, a veteran in the field of revenue and taxation, was among several applicants…

New Commissioner General Approved by Majilis

On 28 October 2019, the People’s Majilis approved Fathuhulla Jameel as the new Commissioner General of Taxation of the Maldives Inland Revenue Authority.

Following the second amendment to the Tax Administration Act, a new Commissioner General was…

Dangerous Chemicals Regulation Published

On 23 September 2019, the “Dangerous Chemicals Regulation” was published in the Government Gazette. The Regulation sets out procedures on the import, storage, sale and disposal of dangerous chemicals.

The Regulation was published under special…

Supreme Court Makes Landmark Decision on Medical Negligence

The Supreme Court of Maldives, on 25 July 2019, has ruled against the State (Ministry of Health) and held that medical negligence was manifest in the treatment administered to Aishath Iyan Ihsan which consequently left her deaf. The appeal filed by the…

Tribunal Declares MIRAs Decision Invalid, Orders Re-audit

On 15 May 2019, the Tax Appeal Tribunal decided, by way of majority decision, in favor of the Appellant, Maldives Passions Private Limited and ordered the MIRA to re-audit the taxable periods under dispute in the appeal case.

The Tribunal, with a majority…